Australia once again demonstrated its resilience with record a low unemployment rate and growing household consumption

Despite the pandemic and the after-effects of supply chain disruption and higher inflation, Australia once again demonstrated its resilience with a record low unemployment rate and growing household consumption. Australia is the 14th-largest national economy by nominal GDP (Gross Domestic Product) and the 20th-largest by PPP-adjusted GDP. As of June 2022, Australia's GDP was estimated at A$1.725 trillion. According to data released by the Australian Bureau of Statistics (ABS), Australia's seasonally adjusted unemployment rate fell 0.1 percentage points to 3.4 percent in October 2022. Bjorn Jarvis, head of labor statistics at the ABS, said: "With employment increasing by around 32,000 people, and the number of unemployed decreasing by 21,000 people, the unemployment rate fell by 0.1 percentage point to 3.4 percent". Men's seasonally adjusted unemployment rate fell 0.3 percentage points to 3.2 percent, the lowest rate since November 1974. For women, it remained steady at 3.6 percent. The seasonally adjusted participation rate remained steady at 66.5 percent, slightly below the historical high of 66.7 percent.

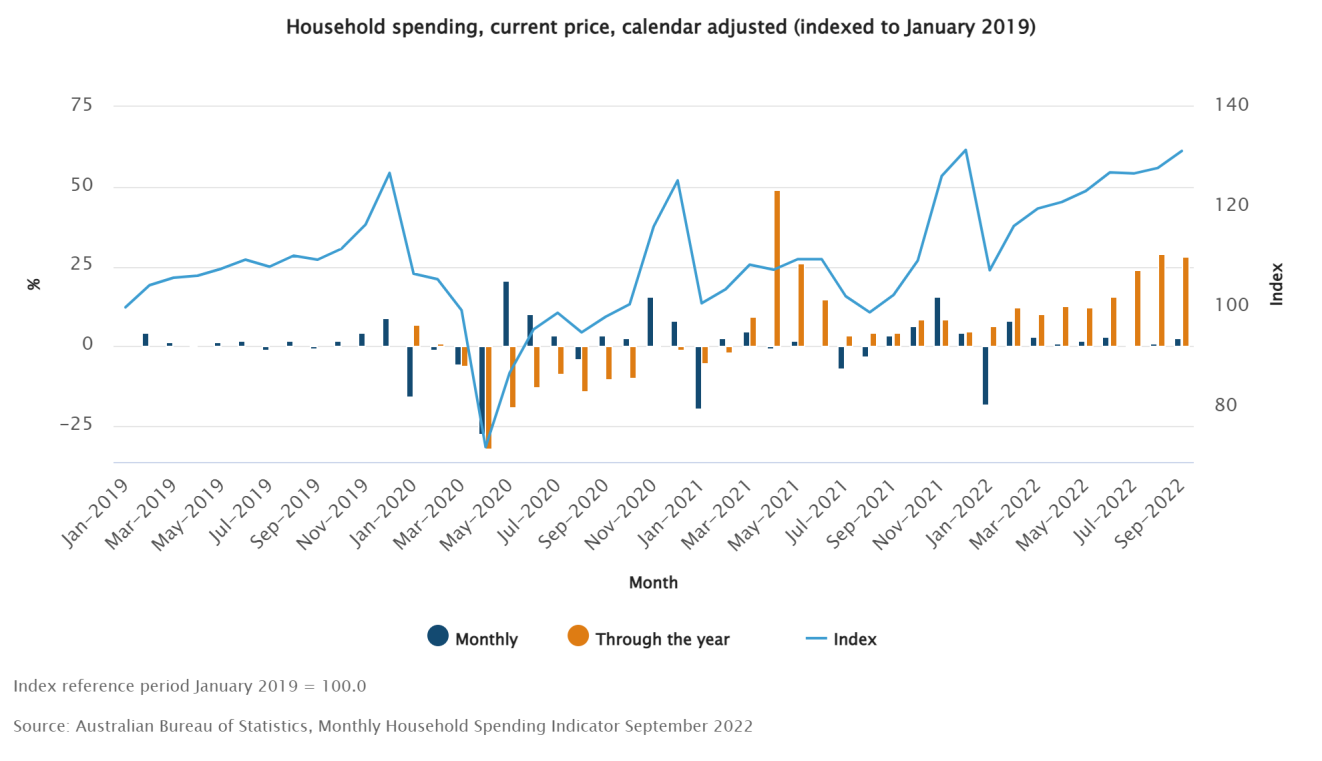

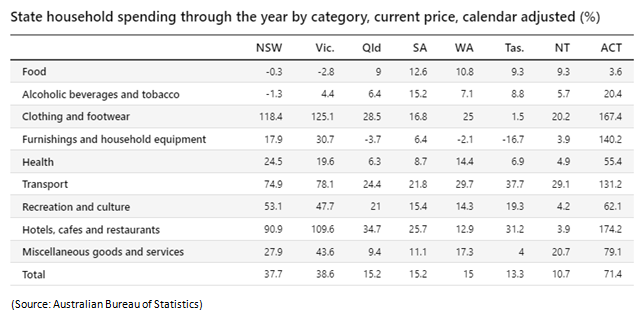

The calendar-adjusted household Index (indexed to January 2019) at current prices increased 28% to 131.2 points in Sep 2022, with household spending rising for both services (+43.0%) and goods (+15.4%). Through the year, household spending on services rose 43.0%, driven by increased spending on transport, recreational, and catering services and goods, which rose 15.4%, driven by increases in clothing and footwear. Household spending through the year recorded increases in all nine spending categories. The largest increases were in clothing and footwear (+73.1%), hotels, cafes, restaurants (+60.6%), transport (+53.0%), etc. All states and territories of Australia have recorded growth in household spending. The strongest increases were in the Australian Capital Territory (+71.4%), Victoria (+38.6%), and New South Wales (+37.7%). In the Australian Capital Territory, the strongest household spending categories through the year were hotels, cafes, and restaurants (+174.2%), clothing and footwear (+167.4%), and furnishings and household equipment (+140.2%). In Victoria, the strongest household spending categories were clothing and footwear (+125.1%), hotels, cafes, and restaurants (+109.6%), and transport (+78.1%). In New South Wales, the strongest household spending categories through the year were clothing and footwear (+118.4%), hotels, cafes and restaurants (+90.9%), and transport (+74.9%).

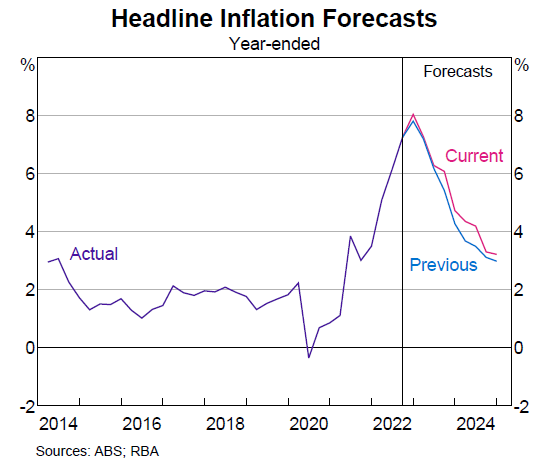

Looking ahead, inflation is a key indicator to watch out for, as household consumption and businesses are both likely to be affected by rising interest rates. As rising inflation means less money will be available as disposable income to households and lesser funds for growth investment in businesses. As per ABS's latest Sep 2022 release, Over the twelve months to the September 2022 quarter, the CPI rose 7.3%. The annual CPI movement of 7.3 percent is the highest since 1990. The past four quarters have seen substantial quarterly rises from higher prices for new dwelling construction, automotive fuel, and food. The most significant price rises were in New dwelling purchases by owner-occupiers (+3.7%), Gas and other household fuels (+10.9%), and Furniture (+6.6%). This is the key reason that central banks around the world are targeting inflation primarily to cool down the heat present in the economy. Not all businesses are affected in the same way; largely it depends on the nature of their market, the types of products and services they offer, and their brand strength. In general, essential goods and services show much lower price elasticity of demand, i.e. lower sensitivity to changes in price.

On the other hand, discretionary items are likely to be affected more by changes in price. Generally, consumers are paying more for branded goods as compared to general goods. Therefore, products associated with high brand power have considerably more inelastic demand, enabling businesses to pass on price increases. In its latest Nov 2022 Economic Outlook, the Resserve Bank of Australia (RBA) has forecasted that inflation will peak at an 8% level by the end of CY2022 and indicated a likely upward revision in the policy rate given a lower farm output due to recent flooding in southeastern Australia and expected above-average rainfall over coming months consistent with the ongoing La Niña event and revised outlook for energy prices. At its November 2022 board meeting, the Reserve Bank of Australia (RBA) raised the cash rate by 25 basis points to 2.85%. This follows a series of rate hikes each month this year, beginning in May 2022. As per the survey conducted by Bloomberg, economists have raised their RBA Cash rate outlook to 3.1% by the year-end.

Financials are not the only potential winners in a healthy rising-rate environment. Some sectors are more sensitive to changes in interest rates compared to others. Sectors like financials, brokerages, and insurance are likely to benefit from higher rates through increased profit margins, an uptick in trading activity, and higher interest income from higher interest rates. Consumer discretionary stocks also can see a bounce back as growing employment and disposable incomes with households will make investors more likely to put their money outside of the realm of consumer staples (food, beverages, and hygiene goods). Manufacturers and sellers of kitchen appliances, cars, clothes, hotels, restaurants, and movies can be benefitted from the economic health dividend of a country like Australia. Finally, the industrials sector will also likely benefit from a healthy rate environment.

AetherReportHub, an authorized representative of AetherSync LLC (LIC No. 2429818.01). Aether Sync has made all efforts to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its website. Aether Sync's research is based on the information known to us or obtained from various sources that we believe to be reliable and accurate to the best of our knowledge.

Aether Sync provides only general financial information through its website, reports, and newsletters without considering the financial needs or investment objectives of any individual user. We strongly recommend that you seek advice from your financial planner, advisor, or stockbroker regarding the merit of each recommendation before acting on any recommendation based on your own specific financial circumstances. Please understand that not all investments will be suitable for all subscribers.

To the extent permitted by law, Aether Sync Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption). If the law prohibits this exclusion, Aether Sync Ltd hereby limits its liability, to the extent permitted by law, to the resupply of the services.

The securities and financial products we analyze and share information on in our reports may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide for more information.