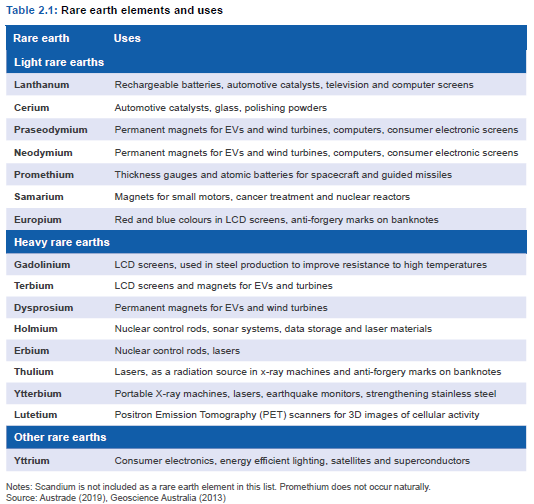

The global demand for rare earth elements increased drastically over the past two decades, in line with its increasing applications in high-end technologies. Rare earth elements are a group of 17 metals made up of 15 lanthanides, plus scandium and yttrium. According to Geoscience Australia, its uses range from routine technologies such as lighter flints, glass polishing mediums, and car alternators, to high-end technology like lasers, magnets, batteries, or fiber-optic telecommunication cables. One of the fastest growing and high-value markets for rare earth is magnets, with rare earth element permanent magnets considered to be three times stronger than conventional magnets and only one-tenth of their size. Permanent rare earth magnets are used extensively in low-emissions technologies like wind turbines and electric vehicles. Other futuristic applications could be high-temperature superconductivity, safe storage and transport of hydrogen for a post-hydrocarbon economy, and as a solution for environmental global warming and energy efficiency issues.

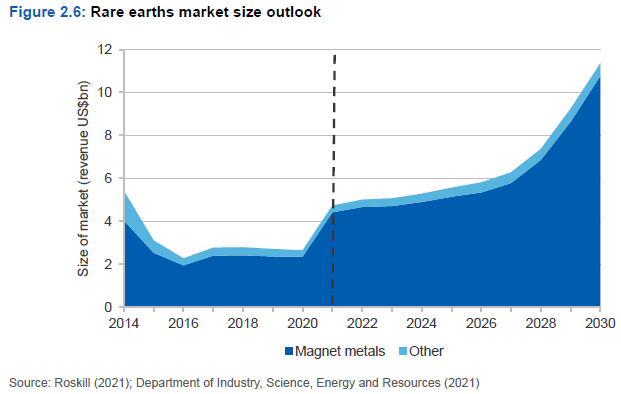

According to a report titled “Outlook for Selected Critical Minerals 2021” by the Office of the Chief Economist, Australia, the consumption of rare earth are projected to grow globally at 4.0% per annum over the next 10 years to 2030, with magnet production to grow by 6.2% per annum, driven by the strong take-up of low carbon emissions technologies. The outlook for rare earth elements varies considerably and depends primarily on their end-use. According to the report by the Chief Economist, Neodymium and praseodymium, in particular, are expected to experience market shortfalls towards the end of the decade. The neodymium-praseodymium market is projected to grow by 35% over the outlook period to 2030. As most producers market mixed oxide, there is a premium for the separated products. Consequently, producers are looking at ways to extract the most valuable rare earth within their total mine extraction. Thus the economics of extraction is increasingly reliant on the ‘magnet elements’. The compound average annual growth for the price of magnet metals over the next 10 years to 2030 (in real terms) is projected to be 8-9%. The global rare earth market was valued at around US$2 billion in 2020 and is forecast to grow to around US$12 billion by 2030.

Australia is ranked sixth in the world in terms of rare earth resources, with a 3.4% share of world resources(economically demonstrated resource of 4,100 kt as of Jan 2021), and fourth in terms of production with a share of 9.4% of world production (2020 Production of 23.7 kt). Over the forecast period (to 20230) Australia’s mined rare earth element production is forecast to grow by 9.1% annually, driven by increased production planned from Lynas Rare Earths (ASX: LYC). Lynas is the largest supplier of refined rare earth (mixed oxide products) outside of China. Processing is currently undertaken in Malaysia, although the first stage of cracking and leaching may take place in Western Australia by mid-2023. Lynas is also looking for additional extraction of dysprosium and terbium. Iluka Resources (ASX: ILU) is also developing its Eneabba tailings operation that contains rare earth in the form of monazite residues. The Eneabba refinery will be fully integrated, producing both light and heavy separated rare earth oxides and capable of processing feedstocks from Iluka's portfolio and a range of third-party suppliers. This positions Eneabba and Australia as strategic hubs for the downstream processing of these critical minerals.

AetherReportHub, an authorized representative of AetherSync LLC (LIC No. 2429818.01). Aether Sync has made all efforts to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its website. Aether Sync's research is based on the information known to us or obtained from various sources that we believe to be reliable and accurate to the best of our knowledge.

Aether Sync provides only general financial information through its website, reports, and newsletters without considering the financial needs or investment objectives of any individual user. We strongly recommend that you seek advice from your financial planner, advisor, or stockbroker regarding the merit of each recommendation before acting on any recommendation based on your own specific financial circumstances. Please understand that not all investments will be suitable for all subscribers.

To the extent permitted by law, Aether Sync Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption). If the law prohibits this exclusion, Aether Sync Ltd hereby limits its liability, to the extent permitted by law, to the resupply of the services.

The securities and financial products we analyze and share information on in our reports may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide for more information.