The Australian benchmark index S&P/ASX 200 (XJO), which accounts for 84% of Australia's equity market recorded a +6.37% gain over the last year to 7,279.0 points, while the All Ordinaries (XAO) Index which is considered a total market barometer for the Australian stock market recorded +5.65% gain over the last year to 7,482.6 points and the S&P/ASX All Technology (XTX) index which is the benchmark for Australian technology-orientated companies recorded +19.79% gain over the last year to 2,569.3 points today. All sectors contributed to the growth except Staples and Health Care. Information Technology, Utilities, and Materials were the top three contributors to the growth of the benchmark index, with +21.57%, +17.95%, and +12.98% changes in price respectively over the last year.

Where the Australian economy and equity market is heading?

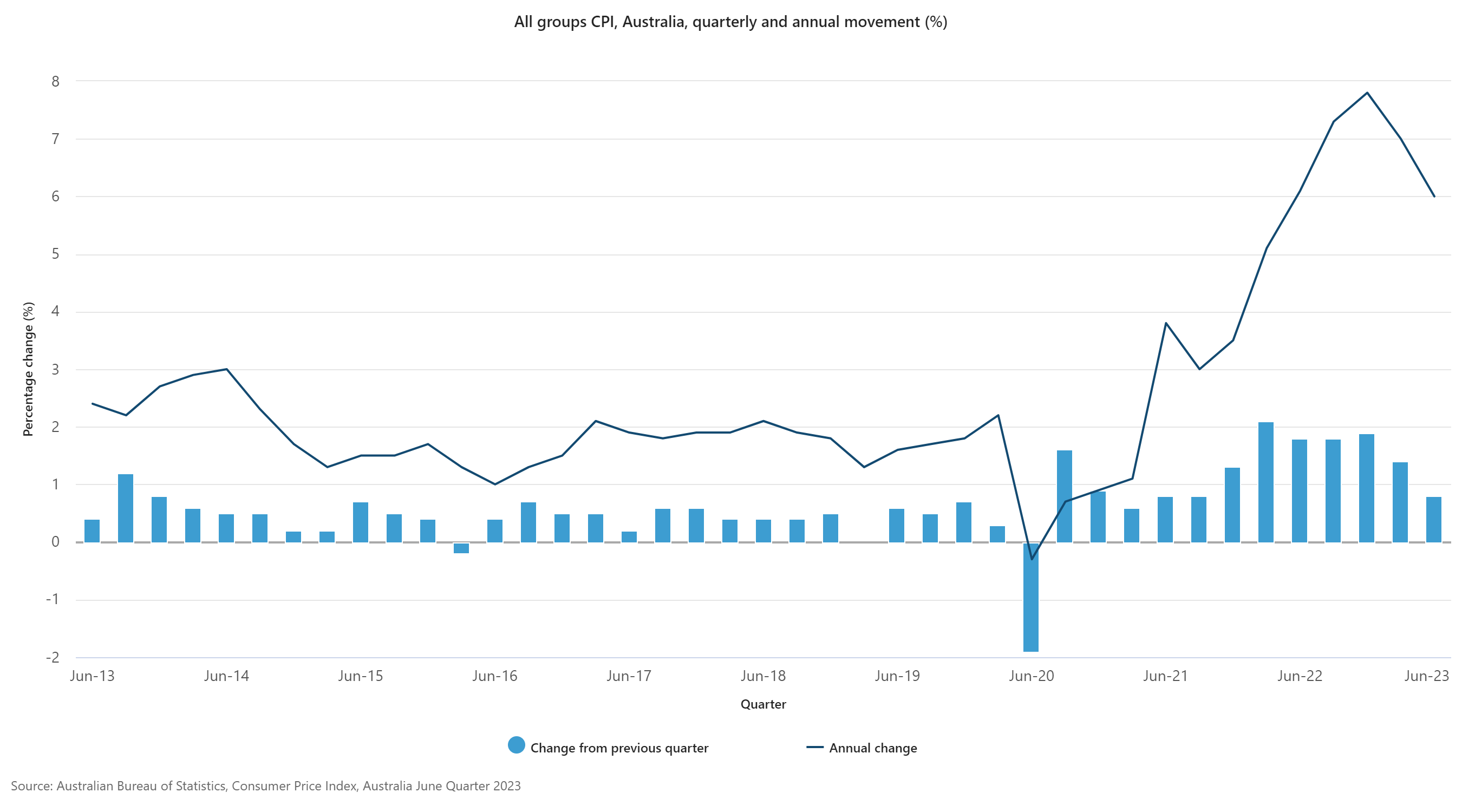

Fortunately, the recently released positive inflation data and RBA’s accommodative stance on cash rate favored the equity market positively. As per ABS data, the annual CPI inflation eases again to 6.0 percent in the Jun’2023 quarter, lower than the 7.0% annual rise in the Mar’2023 quarter. This marks the second consecutive quarter of lower annual inflation, also known as 'disinflation', from the peak of 7.8 percent in the Dec’2022 quarter. However, the headline inflation is much higher than the Reserve Bank of Australia's target inflation range of 2-3%. The central forecast is for CPI inflation to continue to decline, to be around 3.25% by the end of 2024, and to be back within the 2–3% target range later in 2025. In its latest monetary policy decision on 1 Aug 2023, the Reserve Bank of Australia (RBA) kept its cash rate unchanged at 4.10%, indicating lower household consumption. As per the RBA, the Australian economy is experiencing a period of below-trend growth and is expected to continue for a while and the Australian equity market is not isolated from that. Higher inflation and lower consumption are putting pressure on the profitability of companies.

How the reporting season 2023 has panned out?

So far more than 200 companies under our coverage have reported their results for the financial year ending on 30 June 2023(FY23).

- Notably, heavyweights like BHP, RIO, and S32 have reported relatively weaker results compared to the prior year, largely due to lower commodity prices and industry-wide cost inflation due to comparatively higher energy prices in the first half of the year and higher labor costs.

- For FY23, BHP reported a US$11.3 billion or 17% decline in revenue to US$ 53.8 billion and reported a US$7.9 billion or 37% decline in underlying attributable profit to US$13.4 billion. BHP also positioned the company well for the future with a 16% higher capital expenditure of US$ 7.1 billion versus US$ 6.1 billion in FY22, with increased exposure to future-facing commodities.

- RIO Tinto also reported a 10.4%YoY decline in consolidated sales revenue to US$26,667 million and a 34%YoY decline in underlying earnings to US$5720 for the half year ended 30 June’2023, impacted by lower commodity prices.

- S32 also reported a 20% decline in revenue to $7429 million and a 65% decline in underlying earnings to $916 million versus 2602 million in the prior year, impacted by a sharp fall in commodity prices from a record level in many markets in the prior period, and higher inflation and uncontrollable costs.

- For FY23, Commonwealth Bank reported an 18% increase in Net interest income (NII) to $23,056 million, driven by above-system volume growth in business and home lending and an increase in net interest margin supported by an elevated interest rate environment. Net interest margin (NIM) for the period increased 17 bps to 2.07% mainly due to the rising interest rate environment, partly offset by the impact of home lending competition.

- For the half year ended 31 March 2023, the Australia and New Zealand Banking Group(ASX: ANZ) reported a +12% YoY growth in Cash Profit to $3821 million and return on average assets by +5 bps to 0.69%, driven by Australia commercial and Institutional.

- The consumer defensive major, Coles Group delivered a 5.9% YoY growth in Sales Revenue to $40.5 billion and 1.8% YoY growth in EBIT to $1.86 billion respectively for FY23, supported by its products in the value category and a net reduction in direct COVID-19 costs compared to the prior year and Treasury Wine Estates also reported 16.6% YoY growth in NPAT to $376 million and 11.4% YoY growth in EBITS to $583.5m driven by strong Luxury top-line growth from Penfolds, successful price increases across several brands and cost savings from the global supply chain optimization program.

- Consumer cyclical major Wesfarmers Group reported an 18.2% YoY growth in revenue to $43,550 million and a 4.8% YoY growth in NPAT to $2465 million, underpinned by strong divisional earnings growth of 12.9 percent for the year particularly Kmart Group and WesCEF.

For FY23, healthcare major CSL has reported a 31% YoY growth in revenue to $13.31 billion and NPATA by 20%YoY to $2.61 billion respectively on a constant currency basis, driven by exceptional growth in immunoglobulin sales and record plasma collections. CSL is expected to deliver NAPATA in the range of approximately $2.9 billion to $3.0 billion in FY24 on a constant currency basis.

Overall, the equity market was supported by the accommodative stance of the RBA and comparatively lower inflation in recent quarters. Sectorically, the banking sector has performed well, benefiting from the higher interest rate environment, where the Consumer defensive also performed well with the stabilization of the supply chain and lower operating expenses. However, the resources sector was impacted adversely due to a sharp fall in commodity prices and high-cost inflation due to industry-wide labor shortages.

AetherReportHub, an authorized representative of AetherSync LLC (LIC No. 2429818.01). Aether Sync has made all efforts to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its website. Aether Sync's research is based on the information known to us or obtained from various sources that we believe to be reliable and accurate to the best of our knowledge.

Aether Sync provides only general financial information through its website, reports, and newsletters without considering the financial needs or investment objectives of any individual user. We strongly recommend that you seek advice from your financial planner, advisor, or stockbroker regarding the merit of each recommendation before acting on any recommendation based on your own specific financial circumstances. Please understand that not all investments will be suitable for all subscribers.

To the extent permitted by law, Aether Sync Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption). If the law prohibits this exclusion, Aether Sync Ltd hereby limits its liability, to the extent permitted by law, to the resupply of the services.

The securities and financial products we analyze and share information on in our reports may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide for more information.