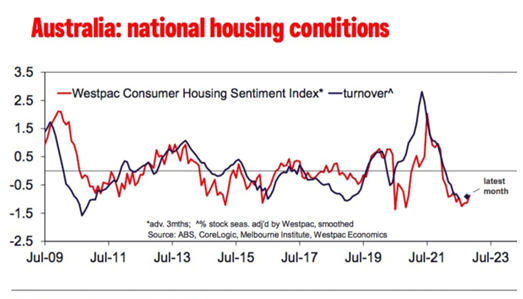

The Australian property market has been on a falling trajectory for the past couple of months due to the changing economic conditions. Australia’s interest-rate increases are continuously putting pressure on the nation’s heavily indebted households and threatening a property downturn on a scale unseen since the 1991 recession. Since May, the central bank has increased the rate by 175 basis points. Inflation has been another main factor behind the huge downfall in the property market in Australia. During the quarter that ended on 30th June 2022, the Australian Bureau of Statistics (ABS) reported an annual inflation rate of 6.1%, which is the highest recorded since 1990.

The market hardest hit is Sydney, where home values have fallen almost 5% in the past three months, compared with 2% in the A$9.9 trillion ($6.8 trillion) national market. Further falls are unavoidable as the Reserve Bank is expected to raise borrowing costs. A Westpac economist has forecasted that Sydney and Melbourne would soon suffer a massive decrease, with property values in the NSW capital predicted to fall 10% this year and then by another 8% in 2023. Nationally, property prices are still expected to fall 16% over the next 18 months.

Impact of Property Crash on Property Stocks – Property crash has an impact on every part of the economy. Investors with their money invested in property and real estate investment trusts (REITs) face devaluations in their portfolios. The vast majority of Australian real estate stocks have faced heavy fall this year, reflecting some pessimism in the market. Goodman Group (GCG), has fallen 25% on a YTD basis. Other major real estate stocks, like Scentre Group (SCG), Dexus (DXS), and Stockland Corporation (SGP), have declined 12%, 21.2%, and 16.2%, respectively.

Tamawood Ltd. (TWD), a residential housing developer stock has fallen more than 34% year-to-date, while another stock Simonds Group (SIO), has lost 50% of its value year-to-date.

Falling Prices Indicates Attractive Buying Opportunity – In the current scenario, properties are taking longer to sell, and sellers are slowly lowering their prices amid a larger number of properties available for sale. While buyers may aspire to purchase at the bottom of the cycle and then sell at the top, ultimately, it’s difficult to time the market perfectly. According to Domain.com (a property listing website), over the last few months, there has been an increase in the listing of the property.

Property Market Outlook

Analysis from the National Australia Bank (NAB) published in June showed that the bank expected a 3.7% average decline in house prices across the country’s capital cities, rising to an average of 14% in 2023. Current negative projections of a 20% median fall in prices could suggest the presence of an Australian property market bubble, that could burst as lending becomes riskier amid rising rates, and negative equity levels possibly increase. Investors in Australian property stocks and related commodities (building materials) used to build homes may look to re-evaluate their portfolio to save their investments against a potential Australian property crash.

AetherReportHub, an authorized representative of AetherSync LLC (LIC No. 2429818.01). Aether Sync has made all efforts to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its website. Aether Sync's research is based on the information known to us or obtained from various sources that we believe to be reliable and accurate to the best of our knowledge.

Aether Sync provides only general financial information through its website, reports, and newsletters without considering the financial needs or investment objectives of any individual user. We strongly recommend that you seek advice from your financial planner, advisor, or stockbroker regarding the merit of each recommendation before acting on any recommendation based on your own specific financial circumstances. Please understand that not all investments will be suitable for all subscribers.

To the extent permitted by law, Aether Sync Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption). If the law prohibits this exclusion, Aether Sync Ltd hereby limits its liability, to the extent permitted by law, to the resupply of the services.

The securities and financial products we analyze and share information on in our reports may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide for more information.