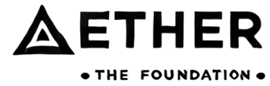

Budgets in any country have profound implications on several sectors and the Federal Budget 2024-25 in Australia is no exception. The Federal Budget 2024-25 was focused on reducing the cost of living pressure while investing in the future to build a more resilient Australian economy. While the Federal Budget 2024-25 is responding to the challenges Australians are facing today, at the same time laying the foundation for future prosperity by easing cost-of-living pressures, building more homes for Australians, investing in a Future Made in Australia, strengthening Medicare and the care economy, broadening opportunity and advancing equality.

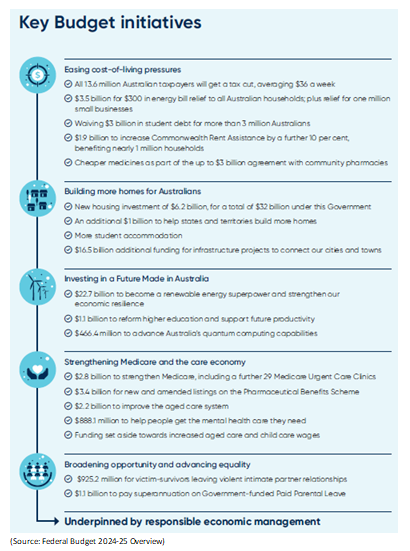

To ease cost-of-living pressures for middle-class Australians, support women, and boost the labour supply, the Government is delivering tax cuts for Australian taxpayers from 1 July 2024. From 1 July 2024, the Government will-(i) Reduce the 19% tax rate to 16%; (ii) Reduce the 32.5% tax rate to 30%; (iii) Increase the income threshold from $120,000 to $135,000 for tax rate applicable above 37%; (iv) Increase the income threshold from $180,000 to $190,000 for tax rate applicable above 45%. The Government's tax changes provide bigger tax cuts for more taxpayers, delivering meaningful cost-of-living relief to middle Australia without adding to inflationary pressures. For example, a taxpayer earning $45,000 or less will get a tax relief of Up to $804 in 2024-25 and a taxpayer including all income groups will get an average tax relief of $1,888 in 2024-25. The Government has provided $3.5 billion in energy bill relief for all Australian households and around one million small businesses. From 1 July 2024, more than 10 million households will receive a total rebate of $300 and eligible small businesses will receive $325 on their electricity bills throughout the year. The Government has also provided $1.9 billion over 5 years to increase the maximum rates of Commonwealth Rent Assistance by a further 10%. This builds on the 15% increase in Sep’2023 and will take maximum rates over 40% higher than in May 2022. The Government’s tax relief measures discussed above will add more disposable income for households.

While initiatives such as easing the cost of living pressure will make available more money for households to spend and would likely affect sectors like retail, hospitality, and entertainment positively, initiatives like building more homes for Australians will create demand for building materials, and steel. The Federal Budget 2024-25 has provided for an investment of $6.2 billion in new housing projects and an additional funding of $16.5 billion for infrastructure projects. The Budget allocated a further $6.2 billion in specific initiatives, taking the Government's total new investment since 2022 to $32 billion. A $1.9 billion investment will further increase the maximum rates of Commonwealth Rent Assistance by a further 10% to further alleviate rental stress. The Government has committed to invest $9.5 billion in infrastructures over the forward estimates, and $16.5 billion over 10 years in projects that will improve productivity, liveability, and sustainability while maintaining focus on the deliverability of >$120 billion, 10-year infrastructure investment pipeline. Apart from investments in housing and infrastructure, the budget has also provided tax incentives to facilitate private sector investments through its $22.7 billion Future Made in Australia package. The Future Made in Australia package will realize Australia's potential to become a renewable energy superpower, value-add to its resources, and strengthen economic security by better attracting and enabling investment in priority areas.

Key incentives-

- The Federal Budget 2024-25 has provided for a $7 billion production tax incentive for the processing and refining of critical minerals

- The Budget has provided $1.5 billion to strengthen battery and solar panel supply chains through production incentives

- $1.7 billion to promote net zero innovation, including for green metals and low-carbon fuels

- Provided $466.4 million to advance Australia's quantum computing capabilities.

- Provided $268 million to support the development of defense industries and skills

AetherReportHub, an authorized representative of AetherSync LLC (LIC No. 2429818.01). Aether Sync has made all efforts to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its website. Aether Sync's research is based on the information known to us or obtained from various sources that we believe to be reliable and accurate to the best of our knowledge.

Aether Sync provides only general financial information through its website, reports, and newsletters without considering the financial needs or investment objectives of any individual user. We strongly recommend that you seek advice from your financial planner, advisor, or stockbroker regarding the merit of each recommendation before acting on any recommendation based on your own specific financial circumstances. Please understand that not all investments will be suitable for all subscribers.

To the extent permitted by law, Aether Sync Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption). If the law prohibits this exclusion, Aether Sync Ltd hereby limits its liability, to the extent permitted by law, to the resupply of the services.

The securities and financial products we analyze and share information on in our reports may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide for more information.