Gold as Safe Haven Assets - With the Coronavirus spreading rapidly across the world, the gold prices have benefitted from this pandemic and hits its 7 year high of $1,814.40. Gold always get benefits from global uncertainty. The Trump trade war with China has increased the investors’ attention last year and this year, the Coronavirus pandemic is taking the gold prices to new highs.

One Year Gold Performance

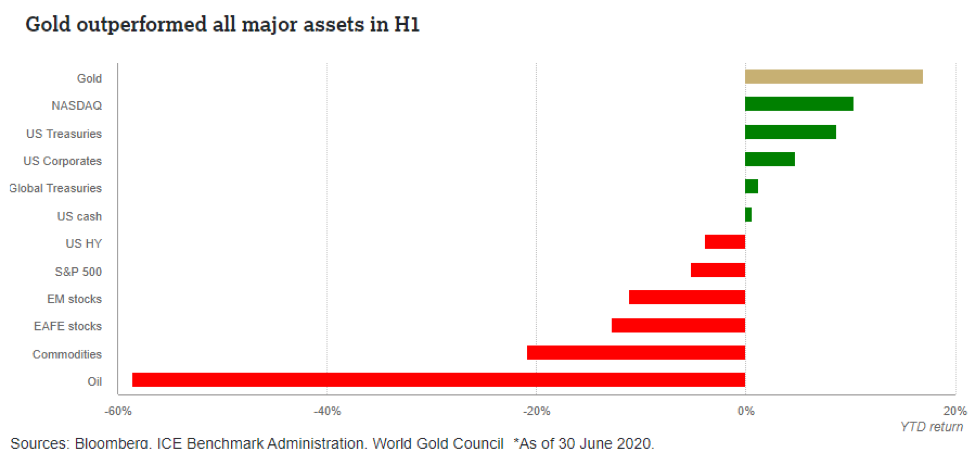

Investors have embraced gold in 2020 as a key portfolio hedging strategy. During H1 FY2020, the gold had a remarkable performance, increasing by 16.8% in US-dollar terms and significantly outperforming all other major asset classes.

Broad Factors influencing Gold Prices:

- Currencies – appreciation or depreciation of the U.S. dollar

- Economic growth and market uncertainty – inflation, interest rates, income growth, consumer confidence

- Tactical flows – price momentum, derivatives positioning

- Gold demand and supply dynamics – mine production, demand-side shocks.

Where this Yellow Shining Metal is Used?

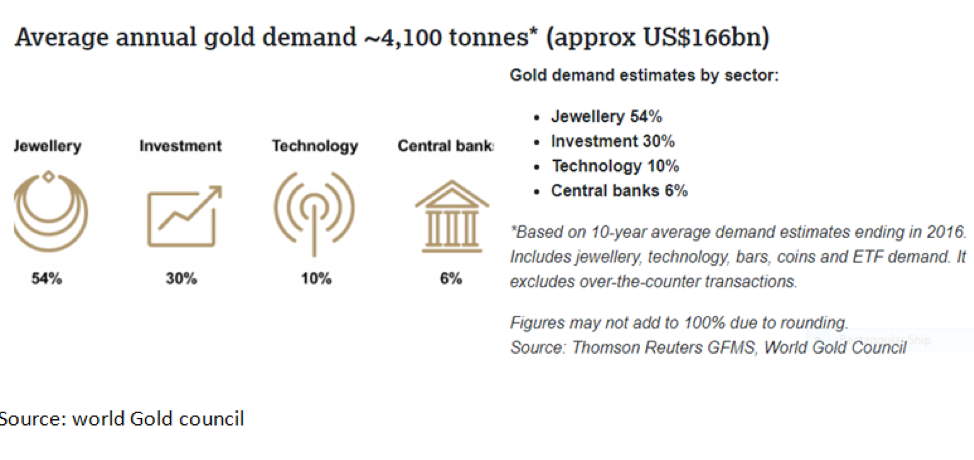

As per World Gold Council estimates the average annual gold demand is ~4100 tonnes per annum which is approximately equivalent to US$166bn. Jewelry, Investment, Technology, and Central Banks are the primary sectors that specifically influence the demand for gold. This diversity of demand and the self-balancing nature of the gold market underpin gold's robust qualities as an investment asset.

Investing in Gold

People across the globe consider gold as a store of value that can be used in times of economic distress. People believe that if all hell were to break loose, i.e. in case of a war or in case the economy or world comes to an end, the only thing that will have any value left will be gold and so it is important to stay invested in gold at all times.

The continuous increase in the gold prices indicates that investors are adding gold to their portfolios to protect against and hedge vulnerability during these times. Investment in gold provides safe portfolio diversification and helps in mitigating losses in times of market stress.

Different Ways to Invest in Gold?

Majority of people invest in physical gold either by buying jewelry, coins or bars. But there are different other ways by which investors can benefit from the rising price of gold.

[1] Buying Shares of The Companies Mining Gold – Australia holds a strategic position in the supply side by being the second-largest gold producer after China. Further, the gold production trend in Australia depicts a positive trend. Look below the performance of some gold producing companies, all have given strong return. The interest in gold stocks was fueled by global economic uncertainty.

|

Gold Producing Stocks |

Price as on 1st April 2020 |

Price as on 17th July 2020 |

Change % |

|

Alkane Resources |

0.63 |

1.24 |

96.83% |

|

Silver Lake Resources |

1.36 |

2.32 |

70.59% |

|

Saracen Mineral Holdings |

3.76 |

5.89 |

56.65% |

|

Evolution Mining |

3.9 |

6.08 |

55.90% |

|

Northern Star Resources |

10.31 |

14.94 |

44.91% |

|

NewCrest Mining |

23.4 |

32.78 |

40.09% |

|

Kirkland Lake Gold |

49.1 |

63.42 |

29.16% |

[2] Exchange-traded Funds (ETFs) are often considered as the next best thing to owning physical gold. ETFs are an investment vehicle traded in shares on an exchange, which tracks the underlying pricing index of that commodity. As per data from gold.org, gold backed ETFs recorded their seventh consecutive month of positive flows, adding 104 tonnes in June 2020 – equivalent to $ 5.6 billion.

Best gold ETFs listed on the ASX:

- ETFS Physical Gold (GOLD) – $1.8 billion in funds under management (FUM)

- Perth Mint Gold (PMGOLD) – $530 million in FUM

- BetaShares Gold Bullion ETF – Currency Hedged (QAU) – $254 million in FUM

|

|

1 YEAR RETURN |

3 YEAR RETURN (P.A.) |

5 YEAR RETURN (P.A.) |

|

GOLD |

27.4% |

16.1% |

10.6% |

|

PMGOLD |

27.1% |

16.9% |

11.1% |

|

QAU |

21.6% |

10.3% |

7.2% |

Source: Stockspot, ASX. Data as of 30 June 2020

Future Outlook: Is it the right time to buy or invest in gold?

There are many supportive factors for the current bull run and the market expects that this momentum will continue during H2 FY 2020 as well. Some of the factors supporting the continuity of gold price run includes:

- Major central banks across the world have reduced their interest rate to almost 0%, with an expectation of going in the negative territory. Rate cuts + Liquidity infusion by central bank is likely to have a spillover effect on the economy and going to support the metal prices.

- The demand for gold in 2020 has been supported by investment demand. Fear driven investment demand in developed countries has contributed to this year’s gain in gold prices. We expect that this trend is likely to continue in the H2 FY2020.

- High liquidity in the system, will spike the inflation rate in the economy. Lack of returns in many other asset classes will drive money towards gold.

Market experts believes that for CY 2020, the gold price is likely to hold support at $1610-1580 zone and the current rally could extend higher towards its all-time high level of $1920. There are also assumptions that the price is expected to extend its bullishness by another 30% to $2500 during FY 2021.

We believe that there is no right or wrong time to purchase or invest in gold. With the prevailing global uncertainty, Investors can consider investing in gold to provide diversification to their portfolio. Rather than holding physical gold, stock market investors can buy shares in companies that have gold exposure, such as gold miners, or they can buy units in a gold-themed exchange traded fund (ETF).

AetherReportHub, an authorized representative of AetherSync LLC (LIC No. 2429818.01). Aether Sync has made all efforts to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its website. Aether Sync's research is based on the information known to us or obtained from various sources that we believe to be reliable and accurate to the best of our knowledge.

Aether Sync provides only general financial information through its website, reports, and newsletters without considering the financial needs or investment objectives of any individual user. We strongly recommend that you seek advice from your financial planner, advisor, or stockbroker regarding the merit of each recommendation before acting on any recommendation based on your own specific financial circumstances. Please understand that not all investments will be suitable for all subscribers.

To the extent permitted by law, Aether Sync Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss, or data corruption). If the law prohibits this exclusion, Aether Sync Ltd hereby limits its liability, to the extent permitted by law, to the resupply of the services.

The securities and financial products we analyze and share information on in our reports may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide for more information.